Editor’s note: This story has been updated to clarify that the $49.7 million funding amount proposed for the Kenai Peninsula Borough School District was included in the budget approved at the Borough Assembly meeting.

The Kenai Peninsula Borough Assembly passed an approximately $83 million general fund budget Tuesday after several amendments and lengthy testimony.

After much debate about fiscal responsibility, how to fund education and what the borough’s responsibility is to nondepartmental organizations, the assembly passed the general fund budget and voted down two tax measures.

Budget set

The assembly amended Borough Mayor Mike Navarre’s proposed fiscal year 2018 budget to eliminate funding he had included for the Central Area Rural Transit System, reduce funding for the Small Business Development Center to $84,000 and reduce funding for the Kenai Peninsula Tourism Marketing Council to $306,000.

Assembly member Stan Welles proposed amendments to zero out the funding for those organizations as well as for the Kenai Peninsula Economic Development District, but assembly member Wayne Ogle intervened with amendments to those amendments that compromised on the funding cuts.

The amendments led to a debate about how much the borough should support such organizations, often referred to as nondepartmentals. Navarre said the expenditures were renamed several years ago as “economic development.”

“They’re now under economic development because they allow us to enhance our economy here on the Kenai Peninsula,” he said. “… The Kenai Peninsula is the size of many small states, and our total budget for marketing for the Kenai Peninsula Borough … is $340,000. If we hired two people to do it in a department it would probably cost us more than that and we wouldn’t get what we’re getting now, which is really bargain rates from the folks who work at KPTMC.”

Speaking to the marketing council funding, assembly member Willy Dunne said the organization also helps support local businesses like water taxis that are tied to tourism.

“In my district I have a lot of businesses that depend on visitors to our peninsula,” he said. “And I think it’s a really modest amount to put in to protect small businesses as well as the visitor industry.”

The assembly also amended the budget to remove an appropriation to start work on the borough building’s heating, ventilation and air conditioning system, which Navarre has said on multiple occasions is aging and in severe need of repair. The new plan is to ask the voters to issue bonds for that project to accomplish it all at once, rather than in chunks spread out over several years, assembly member Dale Bagley said while speaking to the amendment.

“The HVAC estimate for this entire building, which is more than 40 years old, is estimated to be … about $5.1 million,” Navarre said. “This is an aging facility and just simply can’t be ignored. The boiler is the same boiler that was put in when the building was built in 1969. It’s going to crash.”

Several people at the assembly meeting testified to the importance of education and encouraged the assembly to fund the Kenai Peninsula Borough School District as much as possible. Navarre originally proposed in his budget providing the district, which makes up about two-thirds of the borough’s budget, $49.7 million for FY18, a $1.5 million increase from last year. The assembly voted earlier this month to set the minimum amount the borough could fund the district at $48.3 million, but Navarre’s original amount of $49.7 million was included in the budget approved Tuesday.

No new revenue

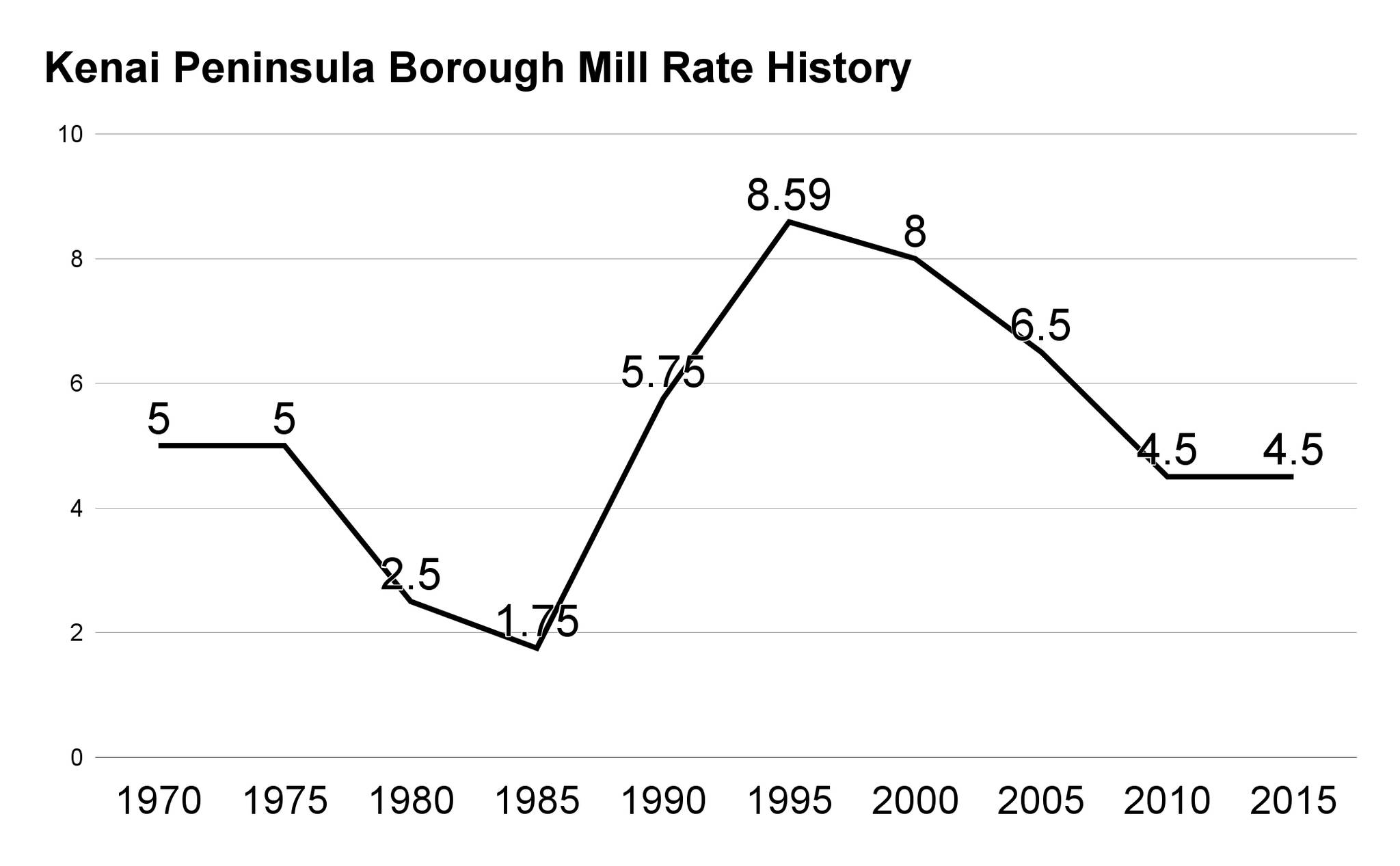

Assembly members debated how best to handle borough finances going forward given the state’s economic downturn before they voted down two tax measures also on the agenda. One would have raised the borough’s property tax rate from 4.5 to 5 mills, a move Navarre said was necessary to avoid dipping into the borough’s fund balance to the tune of $4.3 million this year.

“I get it. The economy is contracting. There’s no good time to raise taxes,” Navarre said. “… I get it, that people struggle during downturns in economies and contractions in the economy, but when’s the last time you heard when the economy was good that we should raise taxes and put money back into the fund balance in order to make sure that when the economy turns down that we’ll have adequate funds in our fund balance in order to make sure we can ride through an economic downturn?”

Bagley amended the mill rate measure to keep the mill rate at 4.5 mills. His amendment passed 8-1, with assembly member Willy Dunne casting the sole no vote. Several assembly members said they don’t feel now is the right time to raise taxes when the state is facing a significant deficit.

Navarre pointed to the borough’s residential property tax exemption of $50,000 and senior property tax exemption of $300,000 in arguing for the mill rate increase. He also pointed out that borough residents have lived with property taxes as high as 8.5 mills in the past.

“We’re not overtaxed here,” he said. “We’re not.”

The assembly also voted down an ordinance brought forward by Bagley that would have raised money by reducing the exemption from sales tax on nonprepared foods from nine months to six months in the borough. It was defeated 6-3, with Bagley and assembly members Jill Schaefer and Brent Hibbert voting in favor.

Bagley made a previous attempt at reducing the borough’s sales tax exemption in 2016, which failed.

“I know that when I’ve tried this before there was some conflicting options on other ideas that assembly members and the mayor had to try to either cut funding or … find some revenue to raise, so I guess I just wanted to give this one more try,” he said.

Borough residents also last year voted down two measures brought forward by Navarre during a tax code revision: one that would have raised the borough’s sales tax cap from $500 to $1,000 and another to phase out the borough’s optional portion of the senior property tax exemption. At the time, he warned that the borough’s mill rate would have to be raised if the sales measures failed.

Navarre said he is confident the budget the assembly approved is a responsible one in terms of spending. The flip side, he said, is making responsible decisions in terms of revenue. If taxes aren’t raised, he told the assembly, the fund balance will continue to erode and the interest income from that fund will continue to decrease.

The borough’s fund balance will be completely eliminated by 2021 “unless revenues are increased in some other fashion or budget reductions are made,” Navarre said. He said the only place left to cut in the budget is education.

“There are some revenue streams that we have to look at and we’ll have to make some tough choices,” said assembly member Kelly Cooper in her closing comments. “I still feel pretty strongly about not taxing the food, so I have no regrets there.”

Navarre summed up the evening’s events during his closing comments with one word: “Speechless.”

Reach Megan Pacer at megan.pacer@peninsulaclarion.com.