Following roughly 80 minutes of testimony to the Kenai Peninsula Borough Assembly in June, the body tabled a resolution that would place a question on the October ballot asking borough residents whether the borough should levy a tax on short-term rentals — often called a bed tax.

The resolution is set to be removed from the table by one of its sponsors and postponed to an undetermined date during the assembly’s next meeting on July 9.

Assembly Vice President Tyson Cox and member Brent Hibbert are the sponsors of the resolution, which says that the borough “must raise revenue to protect the general fund.” It notes that the fund “is declining because of losses in tax revenues due to our generous borough tax exemptions, to the continuing decline in state assistance to municipalities and to the increasing reliance on borough funding for education.”

It says that 49 other Alaska municipalities levy bed taxes which range from 4% to 12%. The resolution says that the proposed borough tax would be “up to” 12%. The borough’s bed tax, if enacted, would be exempted from an existing tax cap of $500 on sales. Similar taxes levied by cities — like the one recently passed in Soldotna — would be exempted “from the borough’s 12 percent” up to one-half of the borough’s tax.

During discussion of the resolution during the assembly’s regular meeting on June 18, representatives of several Kenai Peninsula lodging operations spoke their opposition. Represented in the assembly chambers were Uptown Motel, Aspen Hotels, Driftwood Inn, Land’s End Resort, Alaska Wildland Adventures, the Homer Bed and Breakfast Association, Kasilof Dock RV Park and a short-term rental owner.

Written comment was also received by the assembly from Sleepy Bear Cabins, Seward Properties, Kenai River Lodge, The Duck Inn, Quality Inn Kenai, Best Western King Salmon and AK Moose & Spruce Cabins & Lodging.

Duane Bannock, speaking for Uptown Motel, said that the demand on borough services by visitors is already mitigated by existing sales tax on services and items used by those visitors.

Elizabeth Stark, general manager of the Aspen Hotel in Homer, said that — especially in slower winter months — its Alaska sports teams traveling who provide some of the biggest business. Bumping the price for those schools or parents who are not out-of-state visitors might dissuade them from traveling, she said.

Several other Aspen staff spoke similarly. When asked by Cox how the implementation of a bed tax in Anchorage affected their location in that market, they declined to answer.

Adrienne Sweeney, the innkeeper at the Driftwood Inn, said that a 12% tax could be enough to deter visitors from driving all the way to Homer and staying the night — or that it will motivate them to stay fewer nights. She said that 65% of her visitors are from Alaska — “we already pay our fair share.”

Jonathon Young, who runs a short-term rental in Homer, said that the bed tax in Anchorage has a different impact to the one proposed by the borough because Anchorage has “over 60 corporate hotels.”

“The majority of our lodging options are locally owned,” he said. “Inns, hotels, RV parks, short-term rentals in the forms of both Airbnbs and traditional bed and breakfast … The majority of these lodging businesses are owned by individuals who live here, it will be them who will have to bear the responsibility of this tax.”

Robert Peterkin, who runs Kasilof Dock RV Park, said that his visitors are “probably 90% all Alaskans” because they’re busiest during the dipnet season. As an RV park, he said his biggest competition are free parking lots maintained by the state or at the Walmart in Kenai.

“We’re competing against that,” he said. “This certainly won’t help.”

Several speakers, including former Homer City Council member Heath Smith, suggested a roundtable discussion — held during a less busy time for the hospitality industry than the peak summer season — to share experience and insight. Smith said such an effort could “lay the groundwork to put this on the ballot.” Most of the lodging operations present said that they would be willing to participate.

Jon Faulkner, who owns Land’s End Resort, said that his industry has “a wealth of experience.” They know how many visitors come from where, they know what an increase of only $5 will do to the business, they know why there are more or fewer visitors each year.

“No one ever asks,” he said. “Nobody in the visitor industry supports a bed tax.”

In a written comment, Cox said that such a discussion could happen after the resolution were to be passed, before an ordinance enacting the tax is constructed.

In finance committee earlier the same day, Cox said the introduction of the resolution and the effort to see it added to the October ballot isn’t rushed because of the long wait — more than a year — to see it possibly affected.

Hibbert said that the tax wouldn’t cost local hospitality operations any money because it would be a tax for the users.

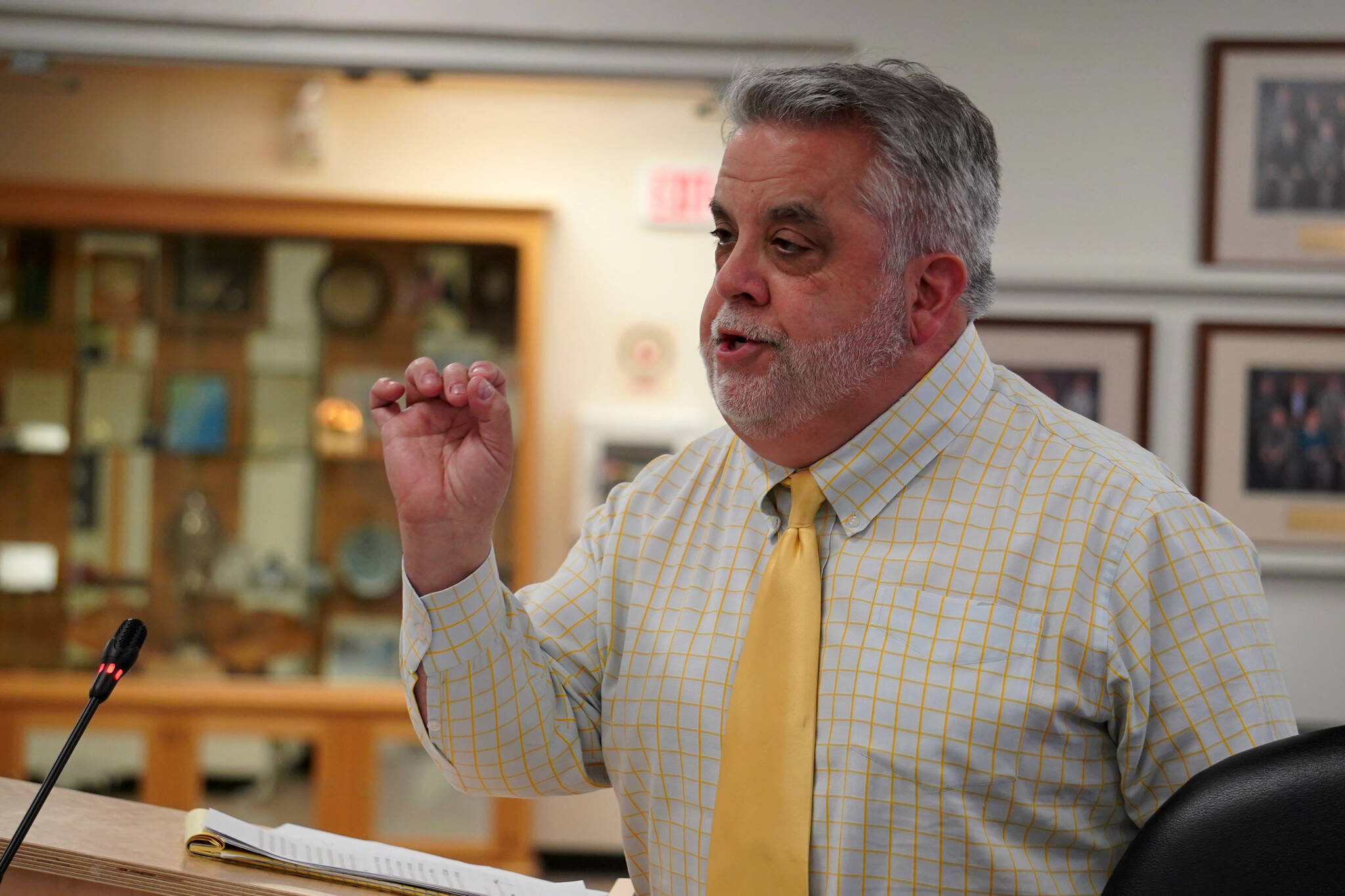

Borough Mayor Peter Micciche said during that meeting that he didn’t think the resolution had yet seen enough consideration. The need for such a tax, he said, wasn’t clear — the impacts of tourism to roads or to Solid Waste are unquantified. He said the borough could dedicate time and effort to answering those questions.

“I say 12% is too much because 12% is too much, but I can’t even suggest an amendment because I don’t know what that balance looks like,” Micciche said. “If we get it right, I think the thing survives and I think it meets the intent of what you all have.”

Assembly member Kelly Cooper said those uncertain details left her wary of seeing the question brought to the ballot. It’s the assembly’s responsibility, she said, to have those questions answered.

Cooper ultimately made the motion to table the resolution, delaying any action on it indefinitely. The motion passed with a vote of 6-3 — dissenting votes cast by Cox and members Cindy Ecklund and Peter Ribbens.

Following the vote, the assembly took an at ease, during which the many hospitality representatives filed from the chambers. Immediately after returning to order, Hibbert called for reconsideration.

If the resolution doesn’t see action before the election, he said, it will be lost entirely. There’s still time to try to get more information and work to get people together to figure out a solution.

After consulting with Borough Attorney Sean Kelley, Hibbert noticed that he would withdraw the resolution from the table during the July 9 meeting of the assembly. At that meeting, he said, he would motion to postpone to a certain date.

Assembly President Brent Johnson said he wanted to make clear that the postponement would be the only action seen on the resolution in that meeting — “so I don’t have people driving up from Homer to speak to this.”

“I appreciate your intent,” Micciche said. “But when you remove it from the table it becomes live. They will be here, and they should be here … anything can happen.”

A full recording of the meeting, the text of the resolution and written submitted public comment can be found at kpb.legistar.com.

Reach reporter Jake Dye at jacob.dye@peninsulaclarion.com.