Standard & Poor’s Jan. 5 downgrade of Alaska’s credit ratings, which caught many state leaders by surprise, was triggered by upcoming bond sales, according to an analyst from the ratings agency.

Gabe Petek, Standard & Poor’s primary Alaska analyst, said in an interview that the agency had a duty to revisit the state’s ratings because of general obligation bond sales scheduled for late January and February.

“If you’re selling debt we can’t just sit back and let it go forward without updating our viewpoint,” of the state’s credit, Petek said.

In August, Standard & Poor’s revised the State of Alaska’s credit rating outlook from “stable” to “negative,” citing the state’s budget deficit growing towards $3.5 billion annually as the main reason for the change. An associated report acknowledged the state’s significant existing savings — currently a sum of about $15 billion — but also said legislators must act quickly to address the pessimistic trend of the fiscal situation in what Standard & Poor’s at the time called a “contentious” state political climate.

The agency officially downgraded Alaska’s formerly sterling “AAA” credit rating to “AA+” for general obligation, or GO, debt Jan. 5. Along with that came single-level downgrades to state appropriation-backed debt and Alaska Energy Authority bonds with a moral obligation pledge from the state to “AA” and “A+,” respectively. A collective negative outlook accompanied the ratings.

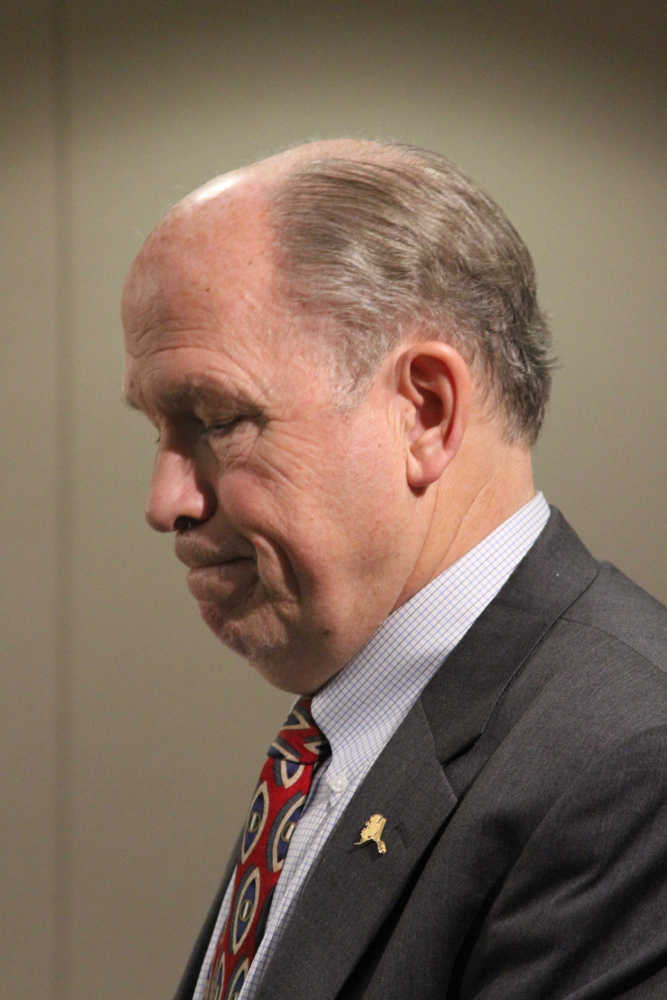

At a press briefing immediately following the Standard & Poor’s downgrade Gov. Bill Walker said his initial reaction was “give us a chance” to address the state’s long-term budget issues during the regular legislative session that begins Jan. 19. He added at the time it was his understanding a bond sale pushed the issue.

Walker put forth an aggressive plan to balance the state budget over several years in early December — a proposal to revamp how the state manages its money through the Permanent Fund, change how resident dividends are paid and increase personal and industry taxes.

Whether it is done using the governor’s plan or another method, there is near unanimous consent among legislators that a major fiscal structure change is coming, and soon, for Alaska.

Senate Finance Committee co-chair Anna MacKinnon, R-Eagle River, said in a Jan. 5 statement that she was disappointed by the decision to downgrade the state’s credit rating so soon after changing the credit outlook and before the session. The agency’s rationale, as MacKinnon put it, in August was that the Legislature needed to stabilize the budget situation.

The specific GO bond sales scheduled for Jan. 20 that Petek said pressed Standard & Poor’s to revisit Alaska’s credit rating are for bond approvals dating back as far as 2005. Those bonds, totaling $38.5 million, are for projects in the Kenai Peninsula and Kodiak Island boroughs and the small Southeast Alaska city of Klawock approved as part of a 2005 bond resolution. Refinancing of a bond for the City of Seward is also included in the package.

Fitch Ratings, on Dec. 23, announced a rating of “AA+” with a stable outlook for the GO bonds, which nearly aligns with Standard & Poor’s overall rating downgrade for general state bonds.

Alaska Municipal Bond Bank Authority Executive Director Deven Mitchell said another state GO bond sale for statewide transportation projects is scheduled for the end of February.

Voters approved those bonds in 2012 as part of a $460 million package.

Public infrastructure projects are long-lived, Mitchell said, so the state bond bank regularly asks the Department of Transportation when it needs funds for various projects.

Alaska’s credit rating downgrade also comes at a time when the Walker administration is proposing a $500 million multi-year GO bond package to fund essential and capital projects along with pension bonds to stabilize the state’s retirement payment obligation.

Mitchell said the downgrade could result in interest rate hikes of about 0.1 percent on future bond sales. Walker equated that to roughly an additional $1,000 per year payment on each $1 million the state borrows.

In several years the state could also look to bond for at least part of its share — at least $13 billion — of construction costs on the Alaska LNG Project. However, the state’s credit rating and fiscal situation will have ample time to change for better or worse before then.

The state’s financial group made a pitch to Standard & Poor’s analysts in an early August meeting just prior to the negative ratings outlook report for a ratings adjustment after the upcoming legislative session to give Alaska’s leaders a chance to stabilize the state’s fiscal situation, according to Mitchell.

“That’s been the state team’s discussion point with the analyst. If you look back 18 months to August of 2014, the price of oil was over $100 per barrel. The state was looking at a balance with a draw on the (Statutory Budget Reserve), but we were going to have growth in the net position of the state because of investment earnings that were going to float a savings in funds like the (Constitutional Budget Reserve), the Earnings Reserve of the Permanent Fund and so we went from that kind of very strong position to a year later trying to deal with a price of oil that had dropped below $50 per barrel and now obviously it’s below $40 per barrel,” Mitchell said. “And it just takes a long time, it’s kind of like you’re in a ship and you want to turn around you can’t just start going the other way; it takes a while to get turned around.”

Petek said the timing of the ratings are not tied to the legislative cycles and that Standard & Poor’s does not try to persuade or pressure political leaders into any decisions. Its reports specific to Alaska simply lay out the state’s bind, he said.

Since the August ratings outlook adjustment the state’s revenue forecast has declined along with oil prices, further exacerbating Alaska’s fiscal issues, Petek noted.

“The problems have gotten larger; that’s one thing, and the state is going to sell debt into the market,” he said. “And we just have a very strong interest in making sure there’s no uncertainty as to what our views are when they’re going to go and sell debt so it kind of forced the issue in a way.”

Petek added that Alaska, at “AA+” remains in a “really strong” position — equal to or better than about half of the other states around the country. It is a rating agency’s responsibility to assess based on a state’s immediate situation and not to predict what politicians will do, he said, and currently Alaska’s fiscal house is deteriorating.

Elwood Brehmer can be reached at elwood.brehmer@alaskajournal.com.