A flat mill rate and sales tax, higher fees at the Kenai Animal Shelter and money for numerous capital projects are all elements of the City of Kenai’s proposed budget for the upcoming fiscal year.

Kenai City Council members, city administrators and department heads convened Saturday for an all-day budget work session, where the proposed budget for fiscal year 2023 was presented. Fiscal year 2023 begins on July 1, 2022, and will end on June 30, 2023.

Kenai City Manager Paul Ostrander described the City of Kenai as having a “COVID hangover” in the form of high inflation and a big boost in city revenue. He said it’s common for governments to grow when they get more money, but that it’s harder for governments to shrink back down when money goes away. To remain sustainable, Ostrander said capital projects are typically cut and or taxes are raised.

“This budget doesn’t do that,” Ostrander said. “It doesn’t grow the government. It really positions the city for success now and going forward into the future.”

Outlined in the proposed budget’s statement purpose are the goals of the city budget, which Kenai Finance Director Terry Eubank read aloud Saturday.

“Meeting the needs and priorities of the community means prioritizing essential services while being mindful that non essential services such as parks and recreation, arts, library and senior services have significant importance to a vibrant, well balanced community in which individuals have a desire to live,” the proposed budget says.

Included in the proposed budget are cost of living adjustments for city employees and a bump in monthly health care premium costs for city employees. The city is also in year three of shifting the cost share rate: Kenai is working to move from a 90-10 cost share to an 85-15 cost share. This year, city employees’ share is 13%, while the city’s share is 87%.

No changes are proposed to Kenai’s sales tax or property tax, also called the mill rate.

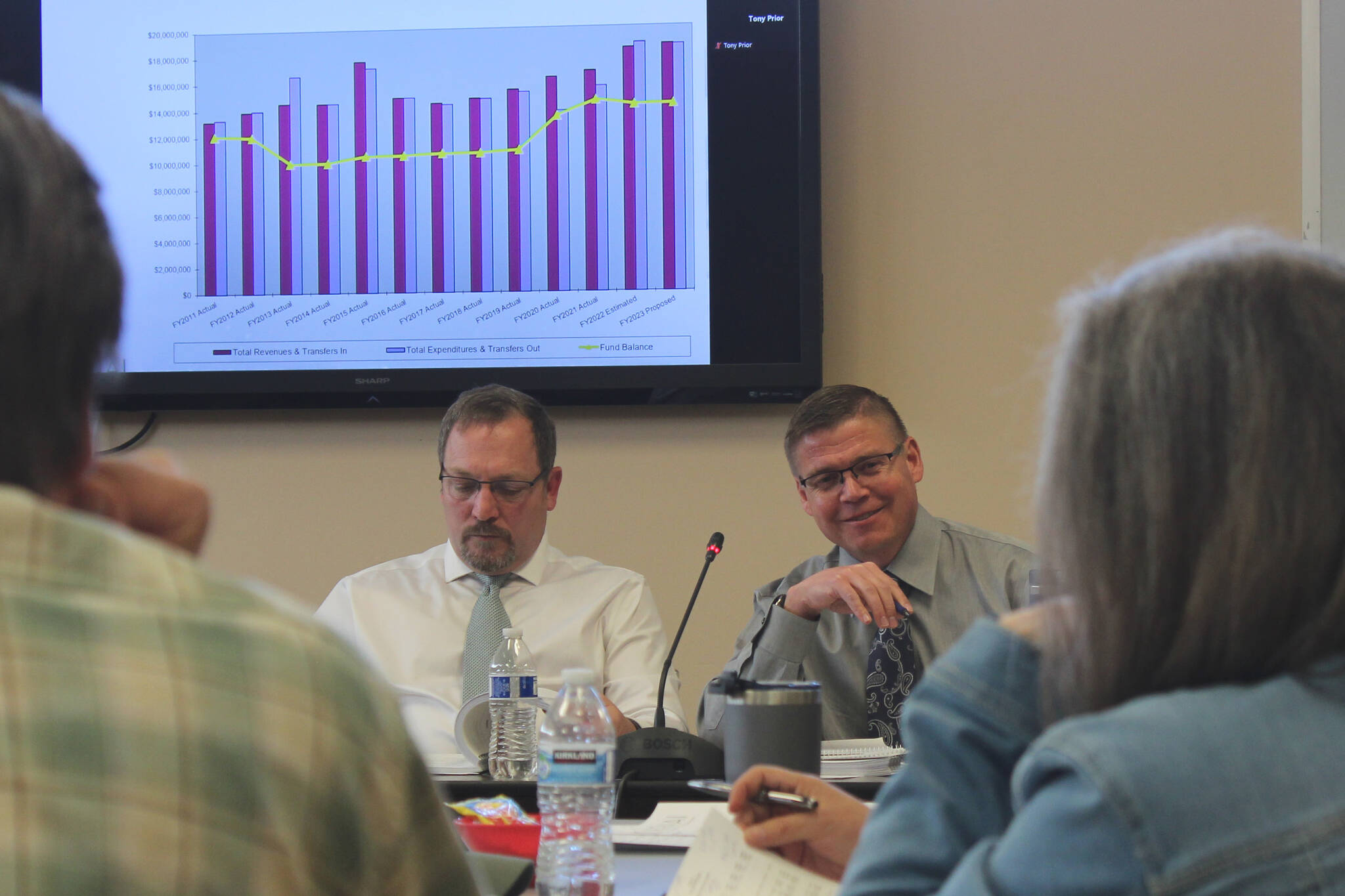

About half of the city’s general fund revenue for the upcoming fiscal year is expected to come from sales tax, while another quarter from property tax. In all, Kenai is projecting general fund revenues of $18.6 million in fiscal year 2023, including about $9.3 million in sales tax revenue and about $4.2 million in property taxes revenue. The city’s sales tax revenue has steadily increased over the previous five fiscal years, with another project increase in FY23.

Kenai city council member James Baisden proposed that the city lower the mill rate as a “symbolic” message to residents that they’re benefiting from the city’s bump in revenue. Because the increase in revenue comes from federal grant programs, Baisden said the money really comes from Kenai taxpayers and that they deserve to benefit from the boost.

Eubank informed council members that lowering the mill rate by .1 mills would save a resident about $25 per year in a sample scenario where a resident’s property is valued at $250,000.

Mill rates are used to figure out how much someone will pay in property taxes during a certain fiscal year. To calculate how much property tax they expect to pay, an individual must divide the mill rate by 1,000 and then multiply that by their property’s taxable value.

Included in the proposed budget are increases in parking fees at the Kenai Municipal Airport: Daily rates would increase from $7 to $8, while annual rates would increase from $700 to $800. In all, there is about $3.15 million worth of capital improvements planned for the airport during the upcoming fiscal year. About $450,000 of that money would come from the city’s airport fund, while the rest would come from non-city sources, such as grant programs.

Residents would also pay more for animal control services through the proposed budget. Nonresidents would be charged double the rates for residents. Soldotna residents would pay the same as Kenai residents because of an existing animal control agreement between the two cities.

Under the changes, Kenai and Soldotna residents would be charged the same amount to drop off felines as they are to drop off canines: $20.40 for cats and dogs, and $35.70 for kittens and puppies. People adopting animals from the city shelter would also pay $15.30 — instead of $10.20 — to microchip the animal being adopted.

The proposed budget also funds the city’s contributions to capital projects described in Kenai’s five-year capital improvement plan for the upcoming fiscal year. Among others, the plan describes about $1.4 million in city General Fund contributions to projects, such as $420,000 for the rehabilitation of Willow Street and almost $400,000 for repairs to Lilac Street.

Kenai also plans this year to put $1.5 million toward the construction of a water treatment pump house, which will update distribution pumps in the city’s water system, $150,000 toward the installation of security cameras at the Kenai Municipal Airport Terminal and $120,000 toward the replacement of shelters and dugouts at the city softball field.

Kenai City Council members will have the option to amend the budget before it is approved. The budget as initially presented will be up for introduction at the council’s Wednesday meeting. If approved for introduction, council members would have the option to approve the budget at the following meeting on June 1.

A full copy of the draft budget can be found on the city’s finance department page at kenai.city.

Reach reporter Ashlyn O’Hara at ashlyn.ohara@peninsulaclarion.com.