The Kenai Peninsula Borough budget has a lot of sliding puzzle pieces.

Every year, the borough administration, staff and assembly spend about four to five months piecing together a picture of what the borough needs to spend for the next year. It includes the property taxes, which have to be divided up according to the lines of its patchwork service areas, and the sales taxes that fluctuate based on the season and respond to economic changes such as falling gas prices and decreasing visitation. It also includes a variety of state and federal contributions.

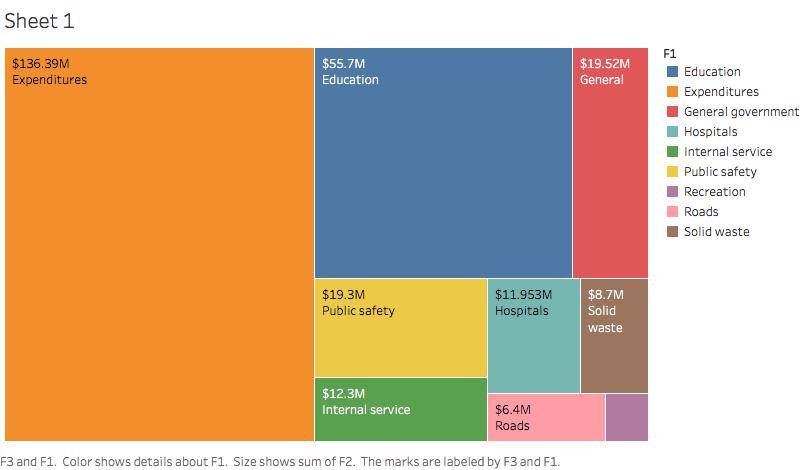

It also includes the various requests from service areas, departments, nondepartmentals and the Kenai Peninsula Borough School District. All the revenue is funneled through the general fund, but much of it comes with caveats — sales tax revenue can only be spent on the school district, property taxes collected in certain service areas can only be spent on those service areas, and so on.

It ends up being a complex picture to put together, reliant largely on the borough’s seasoned finance department.

This won’t be Finance Department Director Brandi Harbaugh’s first go-round with the borough budget, but it will be her first one leading the charge. In her previous role as borough controller, she worked with former finance director Craig Chapman, who’d worked in the borough finance department for about 25 years before retiring in spring 2017.

This year, the borough is starting from an approximately $4 million general fund deficit. The assembly approved a budget that relied on spending some of the borough’s savings out of its fund balance to make ends meet, but if current spending levels and revenue remain the same, that savings account will run dry in a few years.

Borough Mayor Charlie Pierce has said he doesn’t plan to raise taxes this year, relying on finding savings in the borough’s operations and drawing more revenue from land sales.

Revenue

There are three main pillars to the borough’s revenue – property taxes, sales taxes and federal and state contributions, with assorted other revenue sources.

Most of the borough’s funding comes from property taxes and sales taxes — about 72.7 percent in fiscal year 2018. The state and federal government together contributed about 5.75 percent of the borough’s total expected government revenue in fiscal year 2018. By borough code, all sales taxes directly support the Kenai Peninsula Borough School District.

Most of the property tax revenue in the borough comes from oil and gas facilities. Hilcorp is the largest property tax payer, with more than $622.6 million in assessed assets, according to the Kenai Peninsula Economic Development District’s most recent Situations and Prospects report. Altogether, oil and gas properties contributed about $14 million of the total property tax revenue in the borough in fiscal year 2018, or about 20.2 percent.

Real property owners contribute about $50.2 million in total property tax revenue. The base rate in the borough is 4.5 mills, with service area and city mill rates atop those. For fiscal year 2018, former borough mayor Mike Navarre’s administration proposed raising the mill rate from 4.5 mills to 5 mills to support extra funding for the school district. The assembly rejected the increase, saying they didn’t want to raise taxes amid an ongoing economic recession.

For fiscal year 2018, the borough planned for about $29.9 million in sales taxes revenue, based on past years. That’s a little more than half of the borough’s total contribution to the school district, which was budgeted at $49.7 million for fiscal year 2018. Sales taxes have been on the decline, though — they declined about 2.5 percent in fiscal year 2017 and are projected to be down 2 percent in fiscal year 2018, Harbaugh said.

“We’ve been watching the trending of that data, to estimate what people are paying,” she said. “…we did not experience an increase in sales tax. This point, I believe we’re anticipating a decline in sales taxes in 2018.”

The school district administration typically asks for the borough to contribute the maximum amount allowed, known as funding to the cap. The plan is to do that again this year, said Superintendent Sean Dusek at a worksession with the Kenai Peninsula Borough Assembly on Jan. 16.

Federal contributions come largely from the Payment in Lieu of Taxes program, in which the federal government pays the borough a lump sum instead of paying property taxes on the sprawling tracts of land it owns across the borough. That comes in at $2.5 million each year. The state’s contributions include school debt reimbursement, where the state pays a portion of the borough’s expenses for school facility projects, and community assistance funds, which are distributed to the borough’s unincorporated communities each year.

The federal and state governments also contribute money to road projects, economic development projects and capital project grants, but those are not all guaranteed or awarded by the time the budget is completed so the borough does not budget for them, Harbaugh said.

Service areas

Ninilchik residents live about halfway between the peninsula’s two hospitals. However, those who live south of the Clam Gulch Tower pay about 230 times more in taxes to support South Peninsula Hospital than neighbors just to the north.

The two hospitals’ service areas are divided by a line at the Clam Gulch tower, tracing the lines of an old voting precinct. Central Peninsula Hospital has a much larger population in its service area and relies primarily on bonds and service revenue to pay for its operations and expansions, reducing its mill rates to a virtually nonexistent 0.01 mill, or about 1 cent for every $1,000 in property value. By comparison, South Peninsula Hospital depends more on mill rate revenue to operate, and maintains a rate of 2.3 mills, or $2.30 for every $1,000 in property value. So for $200,000 homes, Central Peninsula Hospital Service Area residents pay about $2 per year and South Peninsula Hospital Service Area residents pay about $460 per year on top of their other property taxes.

In Ninilchik, it’s a curious conundrum, because some residents go north and others go south for medical treatment. For the volunteer Ninilchik Fire Department, the split is about 80/20 — about 80 percent of the patients go north to Central Peninsula Hospital, said Fire Chief David Bear.

“Sometimes we give them a choice, whether they prefer one (hospital) or the other, and if it’s not super emergent,” he said. “Generally we go to Soldotna. The bulk of our patients go there.”

The assembly has the final say over the final mill rates in each service area as well as final say in the service areas’ budgets, but the service areas develop their own budget plans. The emergency service areas can get reimbursement for some ambulance services and the hospitals make some revenue from insurance reimbursements and patients’ payments, but most depend on the property tax revenue as a baseline.

Most of the Ninilchik Fire Department’s revenues come from reimbursement for medical transports, supplemented by community donations, Bear said, but it doesn’t have the option of property tax funding because it’s not a service area. The community last voted on it in the late 1990s, but struck it down because the voters weren’t interested in raising taxes at the time. But with Medicare and Medicaid reimbursement declining and volunteers difficult to recruit, they may need to look again at either becoming a service area or joining the neighboring service area of Anchor Point Fire and Emergency Services to the south or Central Emergency Services to the north, Bear said.

The community has been generous with donations and volunteers have been generous with their time, but the fire department struggles to maintain volunteers because they have minimal funding for stipends or support and the community is small. Having the funds to support some staffing could help them keep looking for ways to improve services, he said. However, the community would have to support that, he said.

“We do a pretty dang good job,” he said. “We’ve done a pretty good job for years. We’ve got a new building (that we built with funding) through the state … I think we roll out on just about every call we can and we’re making it work, and I think we’re doing a pretty good job at it. You lose people to jobs and life and it just puts the burden on the people that are there.”

Service areas don’t all have the same funding issues or solutions. Residents of Nikiski actually got a tax cut two years in a row when the Nikiski Fire and Emergency Service Area had more revenue than it needed to meet services, and had enough funds in its fund balance to actually pay for a new fire station planned for the east side of Nikiski without raising taxes or going out to bond. Central Emergency Services has gone out to bond through the borough several time in the last few years to purchase new equipment rather than raise mill rates. The Seward Bear Creek Flood Service Area on the eastern peninsula has looked for grant funding and capital project funding to pay for its creek dredging projects to keep the streams from flooding.

The borough is working through its budget process currently. The administration typically presents a budget by early May and the assembly has to finalize it by June 30.

Reach Elizabeth Earl at elizabeth.earl@peninsulaclarion.com.