Peninsula farmers who experienced hardships due to the drought may be able to receive some federal assistance.

The Internal Revenue Service is offering tax relief for Alaska farmers and ranchers who were forced to sell livestock due to drought, flooding or other severe weather in recent years, a Wednesday press release from the IRS said.

“In most cases, qualified farmers and ranchers whose drought-sale replacement period was scheduled to expire on Dec. 31, 2019, now have until the end of their next tax year to replace the livestock and defer tax on any gains from the forced sales,” the release said. “Sales of other livestock, such as those raised for slaughter or held for sporting purposes, or poultry, are not eligible.”

The federal assistance is being offered to farmers and ranchers in the Kenai Peninsula Borough, Anchorage, Kodiak, Ketchikan, Lake and Peninsula Borough, the Matanuska Susitna Borough, Prince of Wales, Skagway, Hoonah, Angoon, Valdez and Cordova, Wrangell-Petersburg and the Yukon-Koyukuk. Boroughs that border those communities are also eligible for federal assistance.

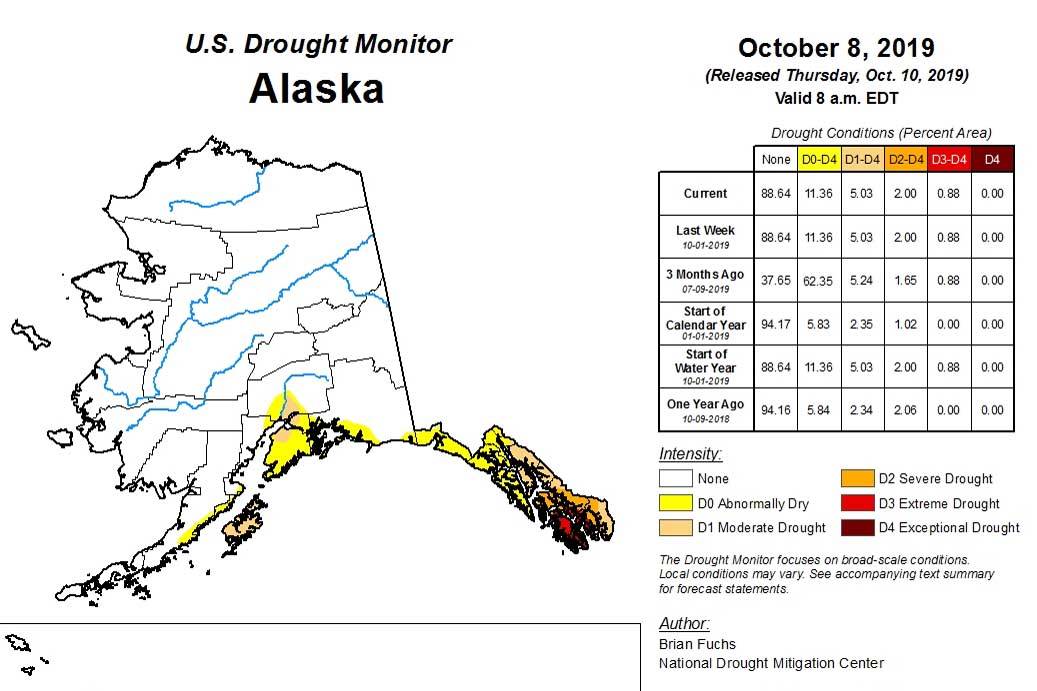

The peninsula’s ongoing drought saw no changes this week.

A majority of the Kenai Peninsula remains in the zero category drought, known as abnormally dry, while the northwest portion of the peninsula is in a category one drought, known as a moderate drought, according to Thursday’s updated U.S. Drought Monitor map and report. Over the summer, areas near the Swan Lake Fire experienced record-breaking dryness and heat, which contributed to a level-three extreme drought in the area.

The U.S. Drought Monitor — produced in partnership with the National Drought Mitigation Center at the University of Nebraska-Lincoln, the United States Department of Agriculture and the National Oceanic and Atmospheric Administration — measures droughts using five levels, level zero being abnormally dry conditions with no drought, and the fourth level being an exceptional drought. The U.S. Drought Monitor Map is updated every Thursday.

More information on reporting drought sales and other farm-related tax issues can be found on IRS.gov.