Land policy revisions that the Kenai city council will be considering next year could bring big changes in Kenai’s dealings with those seeking to use some of its 5,057 acres of municipal land, as noted Wednesday by airport land lessee Rick Baldwin.

“Revision isn’t a good word,” Baldwin said. “Really it’s like a revolution. It’s been a long time coming, and I think it’s going to be very helpful to people having to make investment decisions on leasehold property.”

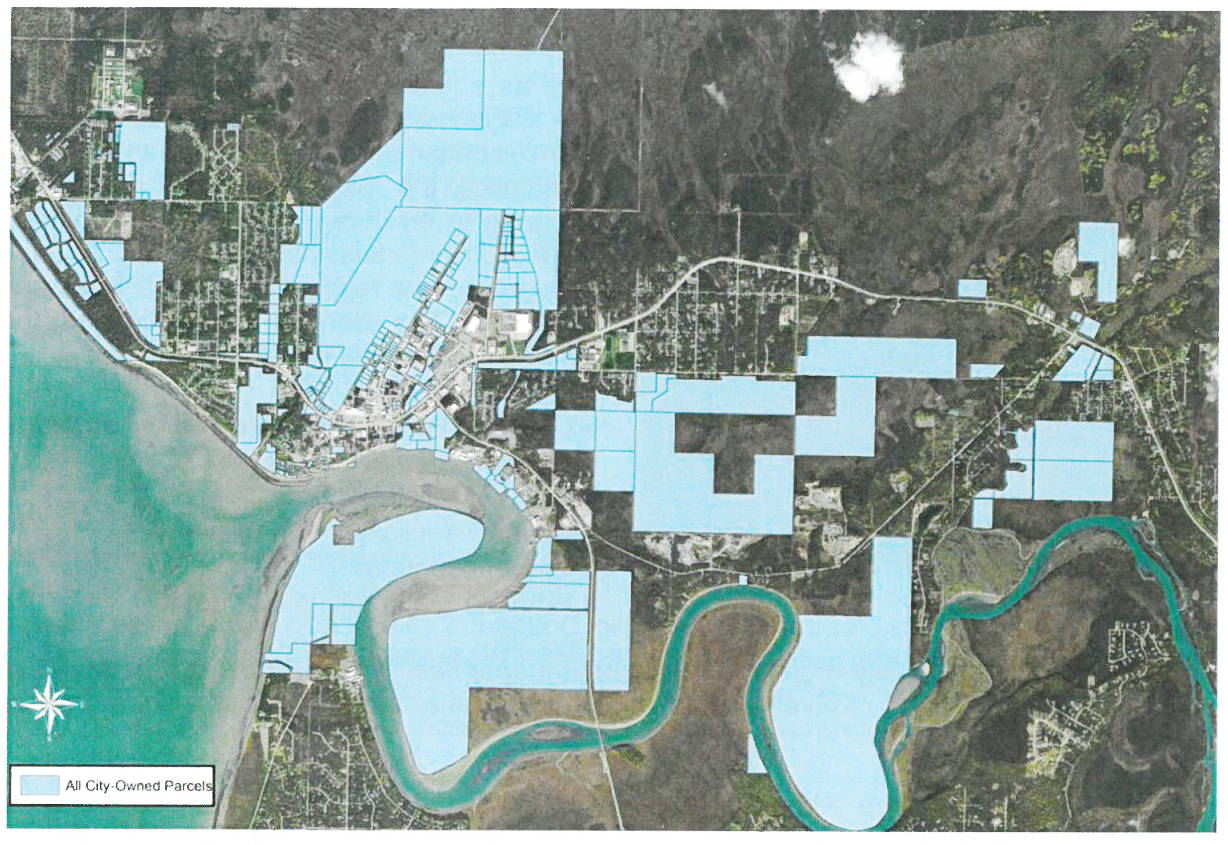

Kenai’s 353 city-owned parcels make up about a third of the city’s area. About 19 percent of city-owned land is presently leased as commercial space, and payments from leasing businesses bring the city approximately $734,696 a year. Some business owners, however, have said the city’s land policies discourage business investment with unattractive conditions, unpredictable rents, and poor odds of eventually buying land from the city at a good price.

The set of land proposals presented to council members at a Wednesday work session are the work of eight Kenai administrators — City manager Paul Ostrander, his assistant Christine Cunningham, finance director Terry Eubank, city attorney Scott Bloom, airport manager Mary Bondurant, and city planner Matt Kelley — who began considering reforms in February 2017.

The recommendations include changing how rents are set for leases, protecting against sudden rent increases, allowing lessees to purchase their lands after spending a certain amount in improvements, creating a friendlier lease application process, determining which city lands are needed for public purposes, and making a marketing effort to sell those that aren’t.

The proposals will be discussed further at the next Kenai Council meeting on Dec. 6, and Ostrander plans to introduce changes for the council’s vote in February 2018.

Land Plan

A city-commissioned report presented Wednesday by the Anchorage-based consultancy the McDowell Group drew the same conclusion as previous studies by Kenai administrators: it is financially better for the city government to lease its land for a continuing stream of revenue than to sell it for a one-time payment.

By design, the McDowell study considered only the city government’s financial interest, excluding any larger economic benefits that may come from selling property, said McDowell Group economist Donna Logan, who worked on the report.

“The city can make decisions to sell lands for a number of valid reasons that aren’t just about lease payments and revenue flow from lease payments to the city,” Logan said. “There’s economic development reasons to sell land, there’s benefit to the business community, jobs, all kinds of factors… But we were asked just to look at the financial aspect of it.”

Kenai presently has no systematic way of deciding when selling a property may be more beneficial than continuing to lease it.

“The City’s land management approach has historically been to manage land as situations arose and without an active management plan or strategy,” the working group’s report states.

Though selling city land to entrepreneurs was once commonplace — in the 1980s the city employed a land manager for that purpose, assistant city manager Cunningham said — such sales have been sporadic in recent years, with city officials recognizing the great incentive to lease instead.

“How do you get to ever wanting to sell it?” Cunningham said. “What economic circumstances ever make that viable? That decision point would probably come best from a land management plan on which parcels to sell. After that decision is made on a parcel basis, not based on who’s knocking on the door, then there’s a methodology for sale.”

The working group’s report proposes a review of city lands “to determine which properties are no longer needed for a public purpose and whose lease or sale would provide a greater public benefit.”

To ensure that salable land ends up with interested developers — rather than speculators who would it hold empty while seeking to raise its price — the proposal would first lease a property, with future sale depending on a minimum investment in improving it.

“The city always says it’s open for business, but a land management plan could potentially make us ready for business,” Cunningham said.

Debates over land sales for non-business reasons have also been an issue for Kenai’s government this year, particularly in the case of the wooded city-owned property called Lawton Acres, which several residents wished to preserve from would-be developers as a barrier between neighborhoods and commercial centers. Council member Mike Boyle — absent at Wednesday’s discussion — unsuccessfully sought to release the property from a legal obligation to financially support the Kenai Municipal Airport.

Council member Bob Molloy, who had supported Boyle’s ordinances to preserve Lawton Acres — said he would favor a land plan that also included the option to preserve some city land from sale.

“I see it as being not only ‘what parcels should we sell or lease?’ but also for an inventory — what parcels are we going to be retaining?” Molloy said. “…“Where do we fit in also the determination of the value of what property should be retained, because it has a value for neighborhoods, separating them from industrial and commercial impact? I’d like to see that worked into the plan, too. How do you value that?”

Setting Rents

Currently, the city sets rents on its leases via appraisals every five years, which are based on recent sale prices of properties that an appraiser deems similar. Past appraisals have had erratic and unpredictable results: after the most recent appraisal in 2015, some lessees experienced “what could be deal breaker increases,” Cunningham said, including one lease that increased by 174 percent.

“That’s something could make the city of Kenai less attractive — the fact that we don’t have protection from that kind of rental hike.”

The revision proposed Wednesday replaces this system with an annual rent change based on the Anchorage consumer price index — a measure of the cost of living that considers changing prices of consumer goods and services.

“It’s more tied to the market, and you can budget around it,” Cunningham said of the proposal.

An analysis done every ten years would determine whether or not a property’s value needs re-appraised.

“That analysis would be a market check,” Cunningham said. “Are we out of market, has there there been extraordinary event — like an LNG plant — that would warrant an appraisal? And if not, we wouldn’t have to do an appraisal. We’d just continue on.”

For aviation-dedicated properties, another proposal would cap increases at no more than 50 percent in a five-year period.

Airport concerns

For 127 parcels of city-owned property, any proceeds they generate are dedicated to funding the Kenai Municipal Airport. These are the remains of the 2000 acres that the Federal Aviation Commission gave the city government in 1963, requiring them to be used for airport support. In recent years, leases from airport-dedicated properties have been about 20 percent of the airport’s yearly revenue.

In 2006, the Kenai council created the airport reserve — an area surrounding the airport that would developed for strictly aviation use, and in which properties would only be leased rather than sold.

Rules for leasing this land are meant to incentivize building on it: the length of a lease depends on the investment a business owner is willing to make in the property. To earn a five-year lease, a business owner must plan to invest up to $100,000. The maximum term is 35 years, for which the lessee would have spend $500,000 in developments. Each additional year afterward requires a $25,000 investment in the property. If the lessee doesn’t extend the lease, their options are to sell to a new lease-holder, or let the property — and whatever they’ve built on it — fall into city hands.

In previous interviews, Kenai airport commissioner Glenda Feeken said that while such leases have generated development on larger airports where there’s greater demand for land, the economic conditions of the Kenai airport don’t make them attractive. Cunningham agreed on Wednesday.

“We viewed some of the 2006 changes as having some unrealistic components for our community,” Cunningham said. “The development schedule was unrealistic. And that proved out by the fact that since 2006 we’ve had five new leases, and they all deviate from our standard lease form that was part of that plan. That tells us it didn’t work.”

The group’s proposed revision would offer a five year lease for a $7,500 investment, going up to a 45 year lease for a $307,000 investment.

Of the 34 parcels in the airport reserve, 22 are leased. Of these, about 30 percent of Kenai’s leases are “in the latter half of the lease,” according to the work group report. Many business owners will soon have to decide whether to renew their leases, attempt to sell them, or allow them to return to the city.

“As more of the City’s leases reach the later part of the lease term, current conditions for extension and renewal discourage the lessee to invest in maintenance or further development was well as potentially restrict the lessees’s ability to sell its lease hold interest,” the working group report states.

Reach Ben Boettger at ben.boettger@peninsulaclarion.com