On Tuesday, Alaskans will have a say in the state’s oil tax structure with a yes vote to repeal Senate Bill 21 or no vote to approve the law.

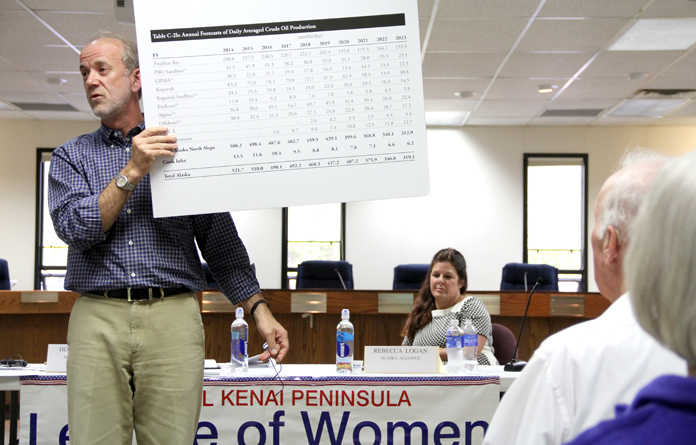

Locals gathered Thursday evening in Soldotna for a forum hosted by the League of Women Voters of the Central Kenai Peninsula on Ballot Measure No. 1. The audience heard from Sen. Hollis French, D-Anchorage, who thinks the law should be repealed, and Rebecca Logan, general manager of the Alaska Support Industry Alliance, who represented the vote to keep SB 21 in place.

In 2013, lawmakers implemented SB 21, which replaced Alaska’s Clear and Equitable Share, or ACES, oil tax structure that was passed in 2007.

French said he thinks some legislators involved in the passage of SB 21 would now like to change their votes.

“We should have negotiated a better deal,” he said. “The reduction in revenues from SB 21 will drain our savings. It will lead to cuts to public education funding and other essential investments we have to make around the state.”

Logan said the only number that matters is production because it is the state’s main source of revenue.

“What we know about production is for every year under ACES production declined,” Logan said.

Since SB 21 passed, she said there has been a “significant” change in activity that leads toward production.

French said while Alaska has gotten a “few more drops of oil,” the state has given up billions of dollars of revenue.

“I think it’s tough to say that somehow this reduction in taxes is going to fill the pipeline,” he said. “The governor promised us a million barrels. … Nobody is making that claim anymore.”

Logan countered French’s statement saying Gov. Sean Parnell didn’t promise 1 million barrels of oil, and that instead he said that was a goal. She said the “drops” of oil are better than what ACES brought the state.

She said the state gave more than $4 billion in tax credits under ACES.

“And by the way, we are not done paying tax credits that were earned under ACES and we didn’t get increased production,” she said.

French said production decline began before ACES went into effect and the activity done under ACES went toward producing more oil.

Using the same investments, flow rates and oil prices, French said if SB 21 would have been in place from 2007-2013, revenues would have been billions of dollars less.

Logan said the comparison is inaccurate because under SB 21, there has been an increase in investment and production and it doesn’t account for the tax credits paid under ACES.

“It’s not the same,” she said. “It’s absolutely not the same.”

She said people make assumptions and cannot give accurate information when they try to answer the question of how much more oil production is required under SB 21 to earn the same revenue that would have been made under ACES.

“The two bills do totally different things, and so any assumptions that you make are not fair to either one or the other,” she said.

French said the industry gets a huge break and Alaska’s revenue cannot be made up in a few thousand barrels of oil.

Both said there is room for compromise between the opposing views.

“I don’t think anybody on the no side says that SB 21 is a perfect bill,” Logan said. “And I think there’s people on the yes side who agree that there’s things in ACES that absolutely need to be fixed.”

But, she said the question is whether amendments and compromise should happen under SB 21 or ACES.

To do compromise correctly, French said, the voters have to repeal “the giveaway” and make changes under the ACES structure.

“Send the Legislature back to work,” he said. “They’ll come up with a better deal this time.”

Kaylee Osowski can be reached at kaylee.osowski@peninsulaclarion.com.