Some Alaskans may still want the state to cut its way to a balanced budget, but Sen. Peter Micciche, R-Soldotna, argues that’s no longer realistic.

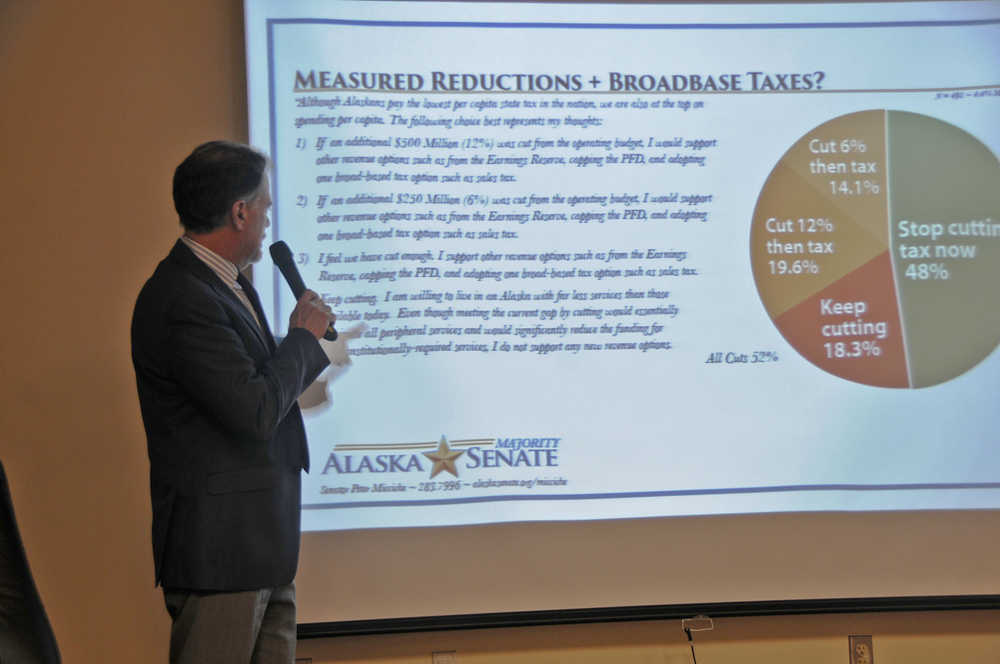

At his annual legislative update Wednesday night at the Kenai Peninsula College’s Kenai River campus, the District O state senator presented the state’s dismal fiscal picture and a slew of options for new revenue. With a nearly $3 billion general fund gap, cutting more will take away many state services, an option he doesn’t want to consider, he said.

The amount of money the state pays annually for education, health and social services departments and in debts is more than the current annual revenue that the state makes — even if every other state department were cut, the government would still have a couple hundred million dollars’ gap, Micciche said.

More can be saved through combining administrative services and other efficiencies, but developing other revenue sources is still necessary, he said.

“I don’t want to live in a state with a $2.2 billion budget,” Micciche said. “I don’t want my daughters to grow up in a state with terrible schools, terrible roads and that’s not safe.”

In a set of presentations, Micciche walked an audience of about 50 through the options available to raise revenue to the state, mostly a combination of different taxes.

Alaska has one of the lowest state-local tax burdens as a percentage of the state’s total income in the U.S., according to an analysis by the Washington, D.C.-based think tank the Tax Foundation. The state also has one of the lowest business taxes nationally, according to the analysis.

One of the most controversial options is to use Alaska Permanent Fund earnings to balance the budget. This would not touch the permanent fund itself — which is protected by the Alaska Constitution — but it could cap the permanent fund dividends and use the remainder as a stopgap to prevent further services being cut, he said.

“There are options to continue paying out the permanent fund dividend… but it’s the single step that has the least amount of effect on Alaskan families,” Micciche said.

Another choice is to cut the oil and gas tax credit program, which has been loudly protested by many of the producers in the state. Micciche said the Legislature is looking at increasing the base rate or cutting the program to bring in additional revenue.

Micciche also discussed the possibility of consumer taxes, such as an income tax or a sales tax.

Alaskans have not paid an income tax since 1980, when the trans-Alaska pipeline was constructed and then-Governor Jay Hammond eliminated the tax. The state is also considering an across-the-board sales tax or sin taxes on items such as marijuana, alcohol and cigarettes.

Micciche said he favors the sin taxes.

He said because the items included are associated with potential health problems, which cost the state’s health care system more later, users should have to pay a little more. He said he also wants the state to look at potential revisions to the educational system that may lower costs per student in rural areas. Micciche asked for school district administrators and teachers to find ways to deliver distance education more efficiently.

“I’m asking over the next couple of years that education brings us some ideas for savings,” Micciche said. “Even if you want to stay flat, you’ll have to bring us some savings. But frankly, I’m not going after education this year.”

Patricia Patterson of Kenai said she does not favor taxes in the first place, but if taxes have to be levied, she would favor a sales tax.

“I don’t want any taxes, but if we have to tax, I like the idea of taxing evenly,” Patterson said. “If you do it by what you spend every day, it seems very even to me. Tourists are taxed, teenagers are taxed, everybody.”

Stephen Severson of Soldotna, who attended the meeting with his wife Marissa, said this was the first time he was presented with much of the information and was still trying to form an opinion on what the best option is.

“I have a lot of work to do as far as becoming acquainted with the issues,” Stephen Severson said. “I buy into what he was saying that you can’t cut your way into (a balanced budget). We could increase a little bit and expect to see some real benefit from that.”

Marissa Severson said it was good for the crowd to hear about the different options and that Alaskans are starting to understand that other revenue options may be necessary. She said younger people may be more amenable to a tax than those on a fixed income or closer to retirement.

“I think it depends on their knowledge of other states and other cities and how that works,” Marissa Severson said. “I feel like a lot of people at retiring age are afraid of state income taxes taking away all their retirement money, whereas young people see it as more of our responsibility to building that up.”

Micciche said he plans to also focus on building the certainty of the Alaska LNG Project in Nikiski and finding ways to streamline the spending on the Alaska Marine Highway System that will not involve drastic cuts.

“When you run out of money you make really poor policy decisions,” Micciche said. “What’s very important is that we don’t gut our state, we continue to live as Alaskans have become accustomed while streamlining our government, eliminating the waste and finding options to raise new revenue.”

Reach Elizabeth Earl at elizabeth.earl@peninsulaclarion.com.