For the first time since the beginning of the COVID-19 pandemic, the Kenai and Soldotna Chambers of Commerce held a joint luncheon.

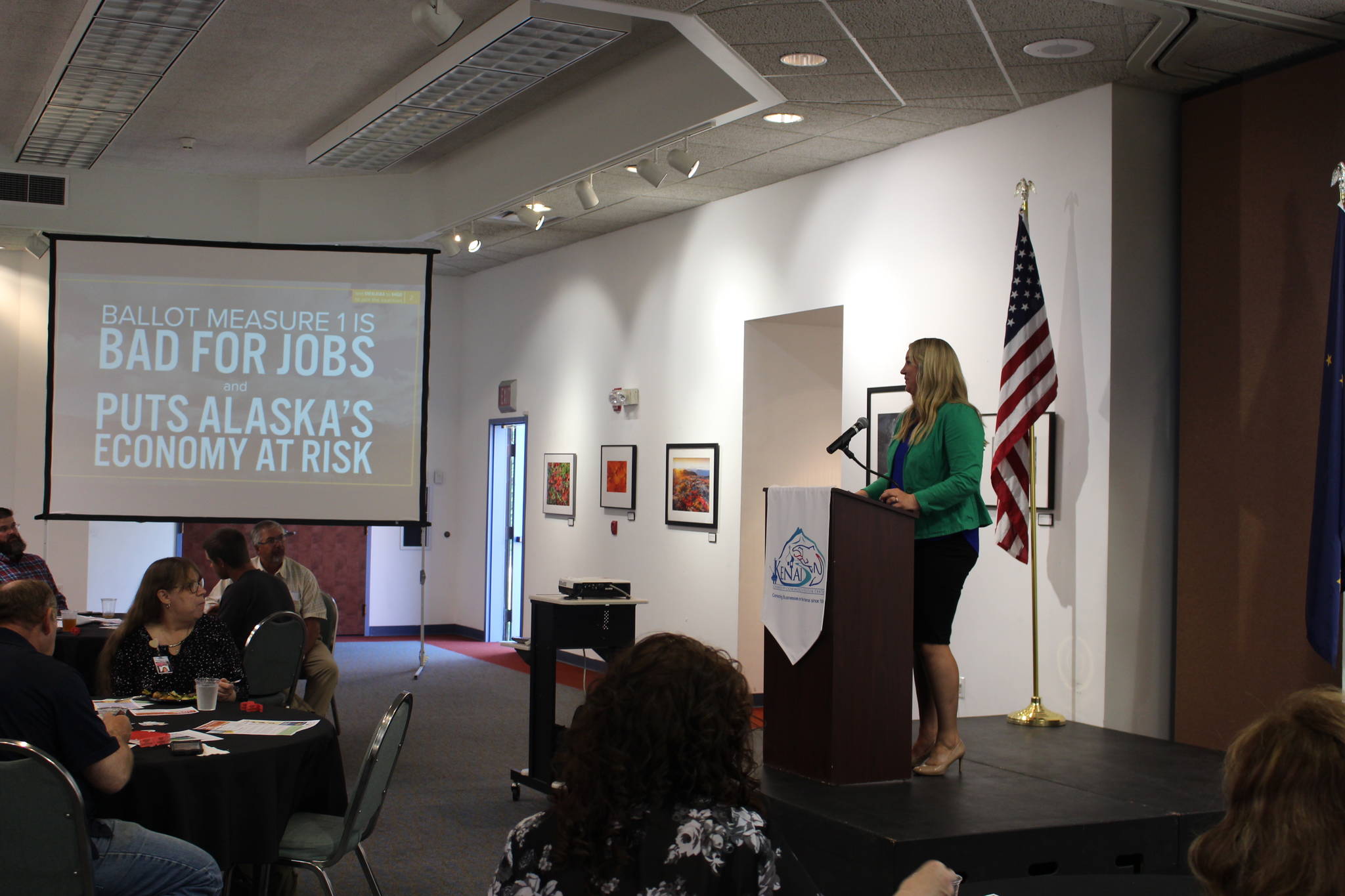

The guest speaker, Jill Schaefer, discussed the Alaska North Slope Oil Production Tax Increase Initiative. The initiative, which Alaskans will have a chance to vote on in November, would increase taxes on oil production fields in the North Slope. Schaefer, a Kenai Peninsula resident and co-chair of the group opposing this initiative, OneAlaska, spoke against the initiative.

“You know, it’s hard because some people who aren’t directly associated with oil and gas don’t always think they see the benefits of it,” Schaefer said during her presentation Wednesday at the Kenai Visitors Center. “But I mean, when it comes to education funding, our roadways, all other services, the amount of the PFD, it does make a difference and it does affect you.”

Schaefer spoke about the role of the oil and gas industry in Alaska’s economy. Using the findings from a 2020 report titled “Oil and Gas Industry in Alaska’s Economy” that was published by the McDowell Group on behalf of the Alaska Oil and Gas Association, Schaefer noted that the oil and gas industry provided 77,600 direct jobs in Alaska for a total of $4.7 billion in wages in 2018.

The industry also spends an average of $4.4 billion with local Alaska businesses and provided about $3.1 billion in tax revenue to state and local governments in 2018, Schaefer said in her presentation.

“It’s really important to have a healthy oil and gas industry in Alaska,” Schaefer said. “That really reflects to a healthy economy and Alaska, because it is so vital to Alaskans.”

Schaefer then talked about what the impact would be of this tax initiative, if it were to pass.

Schaefer said in her presentation that the ballot measure would raise production taxes “between 150 and 300%” based on the price per-barrel of oil.

Under current statutes, oil and gas production is taxed at a rate of 35% of the net value of production. The ballot measure would change the production tax to be between 10% and 15% of the gross value of production, depending on the price of oil, according to the full text of the ballot measure.

Schaefer compared this change to raising the income taxes by 150% on a household making $74,000 annually.

“You can’t say, ‘hey, I’m going to up your taxes by 150% and expect you to invest the same and spend the same,’” Schaefer said. “So it will make a big impact and it will be a negative one.”

Schaefer also argued that the language of the initiative is ambiguous enough that it could end up impacting smaller oil and gas companies, rather than just the larger companies that the initiative is meant to target.

“Bottom line, it puts new projects and existing jobs at risk,” Schaefer said. “Which, right now, we really can’t afford to lose more jobs.”

Schaefer ended her presentation by noting that Alaska’s economy has been struggling with the impact of the COVID-19 pandemic for months. Putting an extra burden on oil and gas companies at this time would only worsen the state’s financial struggles, she said.

“This initiative was a bad idea seven months ago,” Schaefer said. “Right now, it will downright cripple our economy.”

Reach Brian Mazurek at bmazurek@peninsulaclarion.com.