Gov. Bill Walker has proposed the biggest changes to Alaska’s system of taxes and revenue since Jay Hammond signed legislation eliminating the state’s income tax in 1980.

In an Anchorage speech, Walker proposed reviving the state income tax, increasing most taxes already collected by the state, eliminating tax credits given to oil and gas drillers, and turning the Alaska Permanent Fund into an engine that generates revenue for the state.

Walker’s plan would reduce but not eliminate the Permanent Fund Dividend. Under the existing PFD formula, next year’s dividend is expected to top $2,000. Under Walker’s plan, the dividend would be $1,000.

Walker also proposes nearly $200 million in additional cuts to state government operations.

“There’s no one that won’t be impacted by this,” Walker said Wednesday. “I guarantee that everyone in Alaska will find something in this plan they don’t particularly care for.”

Walker’s aggressive plan is the boldest yet suggested for balancing the state’s $3.5 billion annual deficit, which has been caused by the plunging price of oil and rising expenditures.

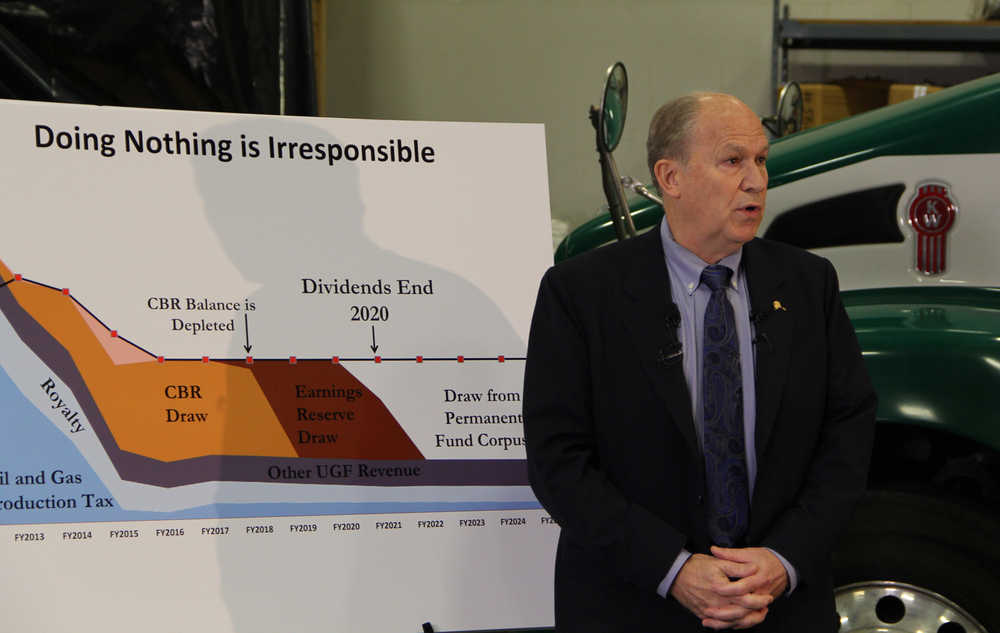

To balance its budget, Alaska needs North Slope oil prices to reach $109 per barrel. On Monday, the price was just over $38 per barrel. This fiscal year, according to an analysis released Tuesday, the state expects to earn just $172 million in revenue from oil and gas production taxes. Two years ago, the state earned $2.6 billion from those taxes.

Since 2013, the state has slashed general-fund spending from more than $8 billion per year. In the 2017 fiscal year, which begins July 1 this year, Walker has proposed a state operating budget of $4.8 billion.

Even those reductions have not been sufficient to close the annual deficit as oil prices have dropped, and the state has been using savings from its various reserve accounts to close the gap.

If the state continues to use savings to finance its annual deficit at existing levels, those reserve accounts will be empty by 2020, and the state will run out of money to pay the Permanent Fund Dividend. The state would be forced to choose between radical spending cuts or spending the $50 billion principal of the Alaska Permanent Fund itself.

“We’re on a path for the Permanent Fund Dividend to go to zero in five years. That’s unacceptable,” Walker said.

Furthermore, global credit rating agencies have indicated that if the state fails to act this year, it may lose its top credit rating, which would make borrowing to finance the trans-Alaska natural gas pipeline more costly.

During a special session of the Alaska Legislature in late October, Walker’s administration introduced a proposal that would turn the Permanent Fund into a money factory for the state.

“It is now clear that, barring a change in the economic environment, that our financial wealth assets will generate substantially more income than petroleum revenues in the future,” Attorney General Craig Richards told the Legislature at the time.

By putting all of the state’s savings into the Permanent Fund and continuing to invest that fund in global markets, the state would earn interest that could be spent on annual expenses.

It’s akin to a person who wins the lottery but banks his winnings and lives off the interest.

In the state’s case, the plan would earn about $3.2 billion per year on a consistent basis. As long as the state averages a 6.7 percent return on its Permanent Fund investments (it has averaged 6.4 percent over the past 10 years — a period that includes the Great Recession), the arrangement could be kept up forever, Richards said.

It would stabilize the state’s income, making it easier to keep expenses from rising when oil prices surge and the state takes in more money. It would also keep the state from drastically slashing expenses when prices drop.

“The idea is that we aren’t going to be chasing oil prices up and down anymore,” Revenue Commissioner Randall Hoffbeck said Wednesday.

The resulting $3.2 billion, even combined with other existing taxes, is not enough to completely close the deficit, which is why Walker is also proposing a broad range of tax increases and new taxes. Among them:

— Implementing a state income tax;

— Higher taxes on alcohol and tobacco;

— Higher taxes on gasoline, aviation fuel and marine fuel;

— Higher mining taxes;

— The elimination of oil and gas tax credits and their replacement with a loan fund;

— Tourism head tax changes.

Those tax changes, broad in scope, are intended to ensure that all Alaskans shoulder a portion of the burden, administration officials said. Precise amounts were still being determined Wednesday, and the administration could only provide a draft proposal without final tax amounts.

The income tax would be 6 percent of a person’s federal income tax returns. A person paying $600 tax to the Internal Revenue Service would pay $36 in state tax, for example.

That rate would be lower than assessed by the state before 1980, when Jay Hammond signed legislation that eliminated the state’s previous income tax. In April, Rep. Paul Seaton, R-Homer, unveiled an income tax proposal of his own. It called for 3.75 percent of annual income to be sent to the state.

“I think that’s a pretty low bar, myself,” he said.

Walker’s proposal works out to 1.5 percent of annual income.

“I think it’s very modest and is actually almost low compared to the taxes paid in the other states,” he said.

Walker’s proposal would be the lowest top state marginal income tax in the country, according to the Tax Foundation. California has the highest top rate, at 13.3 percent. Alaska is currently one of seven states that does not have an income tax.

Walker’s proposal is expected to meet fierce debate in the Alaska Legislature, which will open its regular session on Jan. 19.

Walker said the state needs to take action now to prevent worse consequences later.

“The worst plan is that plan: The plan of doing nothing,” he said.