The Kenai Peninsula Borough Assembly begins the long process of hashing out its budget for fiscal year 2019 on Monday.

The administration has been working on a budget plan for at least the last three months, conferring with department directors and the assembly about possible sources of revenue to help cover services and to cover the approximately $4 million spending gap in the borough’s fiscal year 2018 budget. Borough Mayor Charlie Pierce’s proposed budget reduces some of that gap through proposed spending cuts, but the assembly still has to decide how to cover approximately $3 million of it or risk depleting the fund balance.

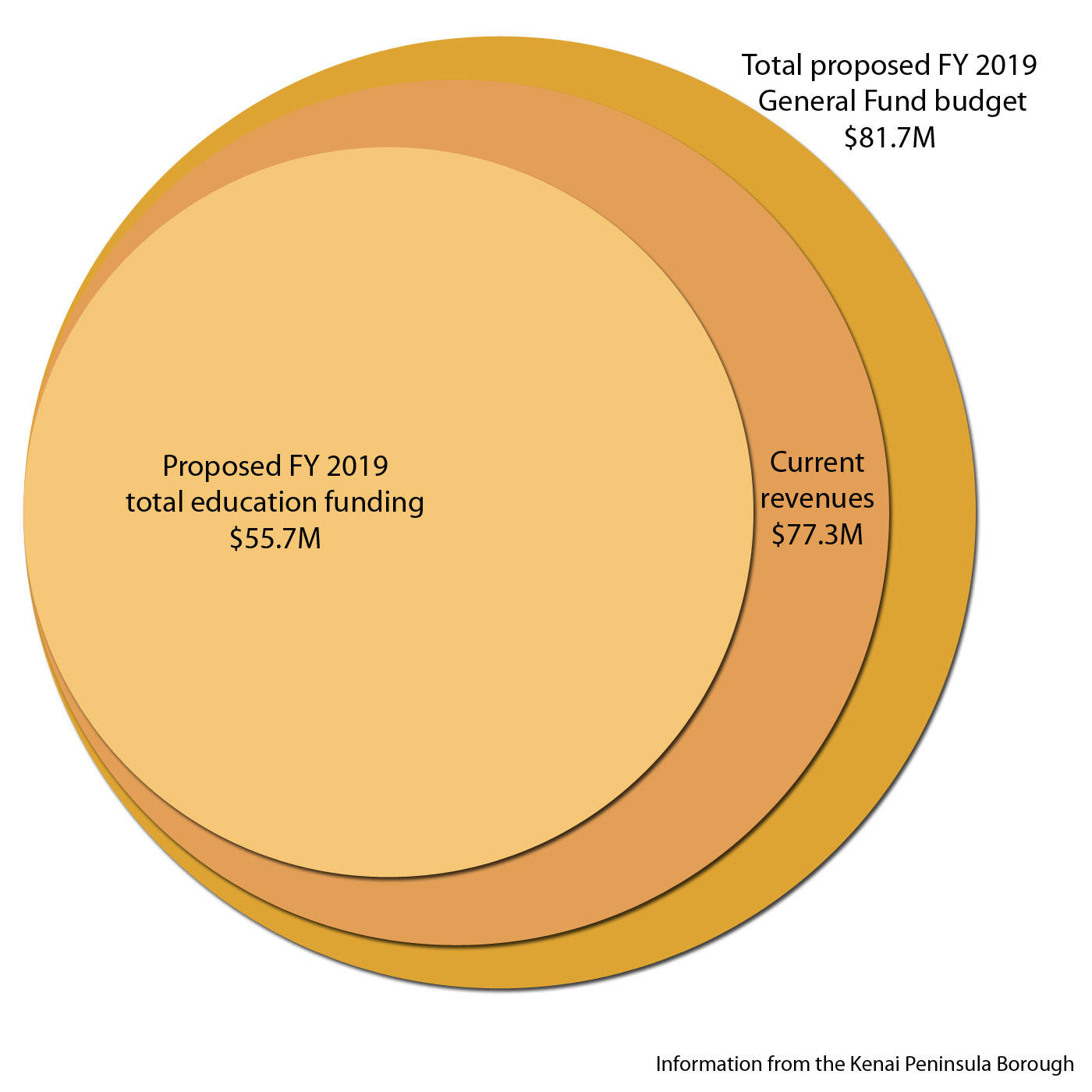

The mayor’s proposed budget includes an approximately $81.7 million general fund budget. That’s not the entirety of borough spending, as it doesn’t include service area spending, among other items. The assembly has the ultimate say over the borough’s budget each year and will spend at least next month reviewing the proposed budget and making adjustments.

The assembly also has to agree on how to address the spending gap, both this year and in future years. So far, any proposed tax increases have been shot down, though more are scheduled for the agenda.

School funding

Among the most contentious items in the budget battles is the borough’s contribution to the Kenai Peninsula Borough School District. Pierce has proposed a $50.7 million local contribution to the school district, which does not include in-kind services through the borough’s maintenance department or school debt service, which comes from the state. In total, the borough’s education contribution would be about $55.7 million under Pierce’s proposed budget.

The local contribution amount is about $1 million less than the maximum possible contribution allowed under state law this year. The Kenai Peninsula Borough School District’s Board of Education approved a budget counting on a local contribution of about $51.7 million before forwarding it to the borough assembly for approval.

By law, the assembly has 30 days after the Board of Education forwards its request to either amend or approve the request. At its May 1 meeting, the assembly is scheduled to hear a resolution approving its contribution to the school district. The total baseline amount named in the resolution is $46.7 million, though the assembly can amend the total.

Land trust

A major part of the plan to balance the budget relies on drawing money out of the land trust fund. The withdrawal requires assembly to approve a resolution authorizing it, which is scheduled for the May 1 meeting.

Pierce’s proposed budget draft does not include the land trust fund withdrawal — without the approved withdrawal or new taxes, the assembly would have to cover the spending gap with the fund balance, which currently sits at approximately $22.9 million, according to the proposed budget. The borough is required to maintain a minimum balance, and continuing to spend out of the fund balance will push that limit.

Pierce has said that he wants to tap the land trust fund this year as an interim to avoid pushing the fund balance limit and to give the borough time to come up with a long-term plan.

“There’s a considerable amount of uncertainty about (new revenue),” he said in a previous Clarion interview. “Anything we do in regards to new revenue, I would encourage the assembly to always go before the voters and ask the voters what their opinions are first. I don’t think we should arbitrarily throw a tax on the backs of the taxpayers without talking to them first.”

His original resolution asked to withdraw about $3 million out of the land trust fund. However, to help fund the school district, he plans to submit an amendment at the May 1 assembly meeting to increase the withdrawal to $4.5 million, according to the amendment memo.

There’s been some skepticism among assembly members and the public about the plan. Assembly member Hal Smalley said he had concerns about using the land trust fund’s principal to pay for government because that is not what it is designed for.

“The budget he presents us with isn’t a balanced budget if it uses these funds,” he said.

Assembly member Dale Bagley said he wouldn’t mind using the interest from the fund’s investments to pay for government, but withdrawing from it to pay for government seems like a temporary fix.

“I don’t know why you’d want raid that money and then not fix the problem,” he said.

Taxes

The assembly has been considering a flurry of tax options since last year, none of which have gone anywhere yet.

Less than a month after voters shot down a measure to increase the cap on taxable sales in the borough from $500 to $1,000 in October 2017, Bagley introduced another resolution to ask voters to approve a bed tax in the borough. After delaying it for several months, the assembly shot it down in March, in part due to objection from the lodging and tourism industry.

Assembly member Kelly Cooper has sponsored an ordinance to ask voters to raise the sales tax from 3 percent to 3.5 percent, adding another 50 cents on most $100 purchases in the borough. The increase would raise about another $5 million for the borough each year.

However, more options are likely forthcoming. Pierce has floated the idea of a 10-cent excise tax on gas this year and potentially changing the tax regime in the future, increasing the borough sales tax to 5 percent and dropping the general fund mill rate to 2.25 mills. Bagley has submitted an ordinance for the May 1 that would repeal the seasonal sales tax exemption on nonprepared foods, also known as the grocery tax. He said he also has plans to reintroduce a form of the bed tax in the future.

Cooper said most of the feedback she’s gotten so far on the sales tax has been supportive for the change, in part because it’s only half a percent.

“That’s the option that is the most palatable,” she said. “There are lots of other options being thrown out there. I think that this assembly is not in agreement in any way, shape or form about what that revenue looks like.”

Bagley said one of the reasons he wanted to reintroduce those tax options are just for discussion purposes. Because of the Open Meetings Act, the assembly members are not allowed to hold conference on ordinances outside public meetings, so that is the only place to hash them out, he said. Plus, staging the hopes for a balanced budget in the future may leave the assembly without a plan if ballot measures to increase taxes fail in the fall elections, as they have the last two years, he said.

“The 3.5 (percent sales tax) takes a vote, the 5 percent takes a vote, the bed tax takes a vote, but a mill rate increase and getting rid of the exemption doesn’t take a vote,” he said. “….There’s a lot of concern about taking a chance on something that has to go to a vote of the people and kick the can down the road.”

Assembly President Wayne Ogle said he saw the task of tax discussion at the assembly like the Greek myth of Sisyphus, who was sentenced by Zeus to eternally roll a huge boulder up a hill only to have it roll down when he very nearly reached the top. He said the assembly is planning to have a joint worksession with the city managers on the peninsula to discuss how taxes would affect the cities, in part to avoid a tax proposal hitting the rocks after the assembly has worked on it.

“I think (the meeting with city managers) would be fair to get everyone in a room to discuss the possibilities, because the borough has to do something,” he said.

Reach Elizabeth Earl at eearl@peninsulaclarion.com.